Female Foundry Week 68: Does VC hype hurt innovation? The balancing act of growth: Rule of 40. April Fundraising Roundup. GPs are putting in more cash. Making unicorns fly again. Dublin Tech Summit.

Welcome to The Week 68, 2023 Edition of the Female Foundry newsletter!

Female Foundry - where investors and female founders meet.

In The News

London-based Centuro Global, co-founded by Asma Bashir, raises a €3.7 Seed round led by Mercia for its AI-powered platform that helps companies to expand overseas; Paris-based Monogram, founded by Beverly Sonego, picks up a €3m Seed round from the family office HWA for its luxury resale brand; London-based HumanForest, co-founded by Caroline Seton, bags a £12m Series A round from family offices and Triodos Bank UK to expand its zero-emission e-bike fleet in London; Also London-based Ambr, co-founded by Zoe Jones and Steph Newton fetches a £900k Pre-Seed round led by Fuel Ventures for its expand its burnout prevention software company; Paris-based neo-bank Green-Got co-founded by Maud Caillaux lands a €5m Seed round led by Pale Blue Dot to fuel the future of sustainable banking.

Amid tech investing slump, Germany’s HV Capital raises a €710m fund to back approx. 30 startups from Seed to Series A with €500k and €5m checks, and 15 growth-stage companies with €10-60m checks. 70% of all deals will be focused on the DACH region, and the rest will be in Europe.

Spotlight

Does VC hype hurt innovation?

Do you remember when just 12 months ago the tech world was all abuzz about the metaverse with hundreds of companies appointing chief metaverse officers? Well, that excitement is over. In 2021 alone, blockchain attracted $32bn of capital. Just 18 months later, blockchain, crypto, and NFTs have all lost their lustre (and 80% of funding). But hold on. There's a new hype in town: ChatGPT and its 100m monthly users. IBM announced this week it is pausing hiring for jobs that AI could do and AI is currently the only category that outperforms others in both the seed and Series A stage funding. How long will it last?

Some think of hype as a public good, vital in enabling new technologies. The truth is, however, innovation requires time for multiple iterations and eventually deeper adoption by users to happen, to be valuable. It took Boston Dynamics 30 years to develop its highly mobile robot, it took SpaceX 7 years, and hundreds of millions spent on failures, to have the first successful rocket launch. What kills innovation is not throwing money at it but rather not following up. The pool of investment capital is limited - we are all experiencing the consequences of it these days. And so as much as excitement (and capital that comes with it) can help unlock even more funding and attract users, today, again, many promising tech companies are out of oxygen, not because they are not legit, but because yet again, they have been overshadowed by something else.

Fundraising

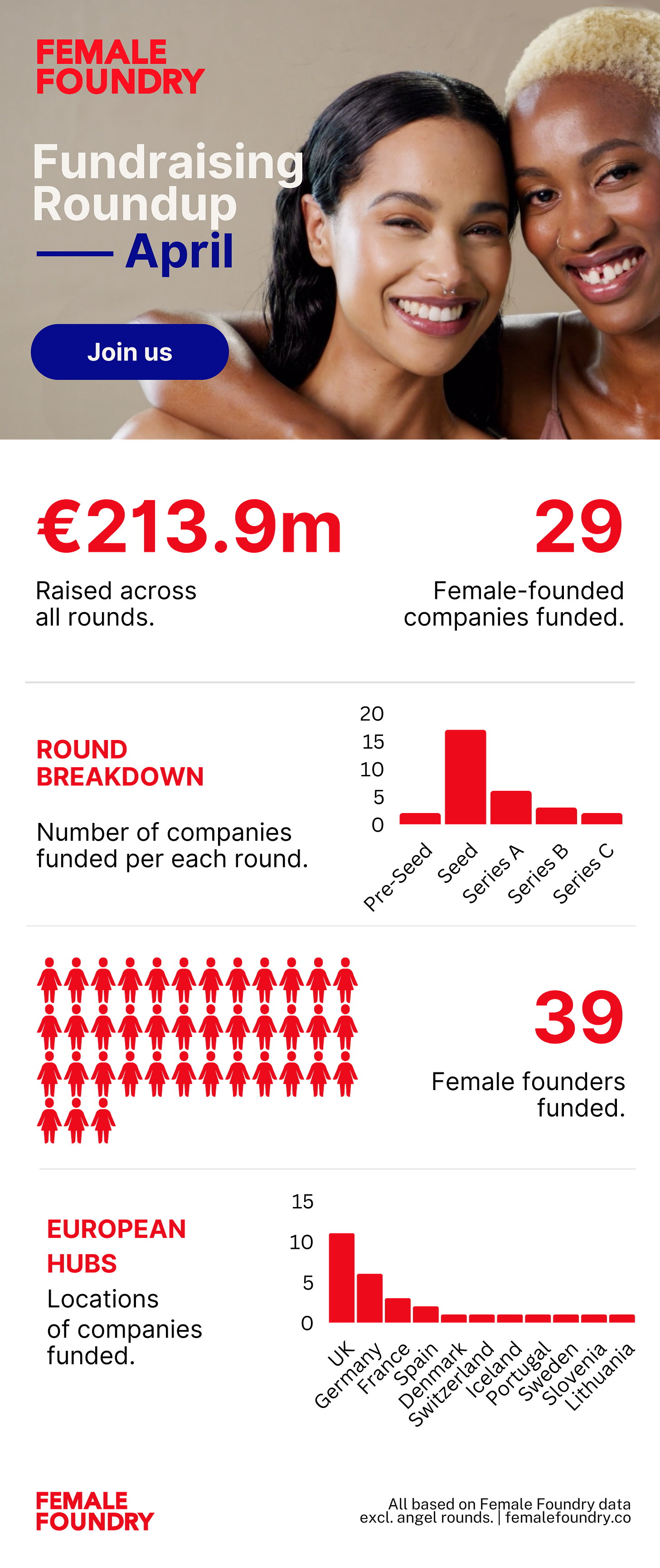

Community fundraising roundup: April.

This has been the hottest fundraising month so far this year - female founders from the Female Foundry community in Europe raised a whopping €213.9m in April!

Balancing act of growth: Rule of 40.

You must have heard it a hundred of times: venture capitalists expect you to grow big and fast. Especially if you are a SaaS company. And SaaS companies burn a lot of cash on their way up. Why is that? The dynamic of high Customer Acquisition Cost to relatively small recurring revenues means that every customer that your SaaS company acquires, results actually in a loss for the company until some payback point in the future. Limited cash therefore makes managing your company’s growth a tough balancing act: if you grow too fast, you’ll rapidly run out of cash. If you focus on profitability, you might compromise your growth. How do you know where to strike the balance?

Coined by Brad Feld in 2015, as the ‘minimum point of happiness’, the Rule of 40 states that your growth rate + your profit should add up to 40%. The Rule of 40 will not help you answer whether your company is growing fast enough or is profitable enough, but rather, it will measure the balance between growth and profitability, and by extension, more broadly, the sustainability of your business. So, if you are growing at 20%, you should be generating a profit of 20%. If you are growing at 40%, you should be generating a 0% profit. If you are doing better than the 40% rule, that’s awesome. For larger companies, beating the Rule of 40 in a single year isn't unusual - the best SaaS companies can achieve a gross profit ratio of 50%+. Maintaining consistent strong performance against the Rule of 40, however, is challenging. Read full story ➯

Analysis

GPs are putting in more cash.

KKR put over $1bn of its own capital into its latest European VI fund, announced last month. $1bn, that is 12.5% of the fund's total, is well above the usual GP commitments, which tend to be between 1% and 5% of the fund. And while the move might sound like a complete outlier, it is not. More and more private equity and VC firms are amping their GP commitments to demonstrate even stronger alignment of interests with their LPs during the turbulent times. While, it is not always clear how the bigger commitments are being financed, it tends to be a mix of the capital coming directly from partners, lines of credit or the balance sheet. The trend will for sure affect micro fund managers, that have already been feeling defeated by the shrinking pool of LP capital. Read full story ➯

Making unicorns fly again.

FCA announced this week it is proposing new set of rules to simplify UK public listings, replacing the current fiddly premium and standard listing segments with a single class. Many restrictions from the premium category will also fall away: companies will be able to award directors shares with higher voting rights for up to 10 years and transactions between listed companies and related parties, or even large deals, will not need to be approved by shareholders. The move is meant to attract more tech and early-stage companies into the UK and boost the UK's attractiveness against more relaxed financial centres, such as New York, as a listing destination. - UK IPOs currently account for only 5% of global IPOs. Will it be enough to make a meaningful change? Read full story ➯

From the Community

Dublin Tech Summit x Female Foundry

Female Foundry is the official partner of Dublin Tech Summit taking place on the 31 May - 1 June in Dublin and we have 10 x €435 excl vat complimentary tickets to give away to the first 10 people from the Female Foundry Community who enter the draw!

To enter the FREE ticket draw, submit your interest below. Deadline: May 10, 10pm BST. T&C of Dublin Tech Summit apply. I will announce the winners here next Saturday. Good luck!

To receive the 50% discount code on other ticket types, reply to this newsletter.

Ticket draw: TechEU | 24th of May 2023 | Brussels

The winners of the TechEU conference complimentary tickets are Anna (73Thyd), Lara (9ahysg), Coralie (NaUd73), Mariangela (xYd7y3), and Armik (sTy5a6). Congratulations! I will get in touch with you shortly.

Hiring

This week hiring:

Clue ➯ Senior System Administrator | Agreena ➯ Sales Enablement Manager | EDITED ➯ Global Payroll Coordinator.

See more jobs on the Female Foundry Job Board.

Founder & Investor Meetups

Monday, May 8, online ➯ First steps towards angel investing Tuesday, May 9, London ➯ How to find your Product Market Fit | Wednesday, May 10, online ➯ Networking for Female Entrepreneurs | Thursday, May 11, London ➯ Ashurst Fintech Legal Labs - Investor Day (respond with your name) | Saturday, May 13, Stockholm ➯ Startups Fund Raising Program.

Greetings from Brussels. Enjoy your weekend!

Agata

Written by Agata Leliwa Nowicka, an investor, a startup adviser, a two-time entrepreneur, and a founder of Female Foundry based in London.

Suggestions? Drop me an email.

Check femalefoundry.co for more fundraising tools and investor content. View other Female Foundry articles.

♡

Thank you Mariangela Cordella from Nauta Capital for sourcing our weekly meetups.