Female Foundry Week 56: Everyone wants to be.. an accelerator. Investor checklist. How to manage your first investor call. January Roundup. Secondaries are flooding the market.

Welcome to The Week 56, 2023 Edition of the Female Foundry newsletter!

Female Foundry - where investors and female founders meet.

In The News

Finland-based startup, Skipperi, co-founded by Anna-Leena Raij picks a €7m Series A round led by Yamaha Motor to make renting boats accessible worldwide; UK medtech startup Teleatherapy, co-founded by Clare Meskill, picks a €700k Pre-Seed round to improve access to speech therapy for people living with Parkinson’s disease; London-based deeptech startup Instill AI, co-founded by Xiaofei Du, fetches a £2.9m Seed round, led by venture capital firm RTP Global.

Spotlight

Everyone wants to be.. an accelerator.

Since the creation of the world’s very first accelerator, Y Combinator in 2005, we have seen an explosion of accelerator programmes. It is reported that in Europe alone there are currently over 400 active accelerators, and that number is rapidly growing.

Today, choosing the right accelerator programme can be overwhelming for founders. Critics of the trend also point out that more and more accelerators, instead of focusing on delivering value, adopt a “spray and pray” approach, accepting hundreds of startups, offering highly standardised one-size-fits-all learning and questionable mentorship. While big names are joining the accelerator pack, Sequoia in March last year launched Arc and A16Z in October launched Crypto Startup School, and more options are becoming available choosing the right accelerator has become a challenge. And therefore before jumping into an application process, every startup founder should still check whether joining an accelerator is a good fit for their business in the first place. Read full story ➯

Fundraising

How to manage your first investor call.

So you have landed your target VC investor call. Now let’s get to work. As about 90% of all first investor calls lead to “No, thank you”, it is crucial that you not only understand the objectives of your first call, but are also rigorous about executing them. If I was to describe the sole purpose of your first investment call, it is for it to lead to a follow up call. And this is only going to happen if the following six are true 1. An investor understands your business. 2. Likes it. 3. Likes you. 4. Is curious to learn more. 5. Your startup fits within her/his investment strategy 6. And the timing is right (that’s hard to manage).

Managing your time on the call is critical to achieving all this. My first calls take 30mins - industry average. That’s enough to say hellos (2mins), next steps and goodbyes (2mins), learn a bit about you (2mins), the problem you are solving (2mins), solution (4mins), tech (3mins), market (1min), traction and GTM (4mins), team (2mins), follow up questions (5mins), your fundraising plans (2mins), and .. breathe (1min). So go horizontal. Don’t cover details. Make it conversational but be concise! About 20% of founders do this and it makes a huge difference.

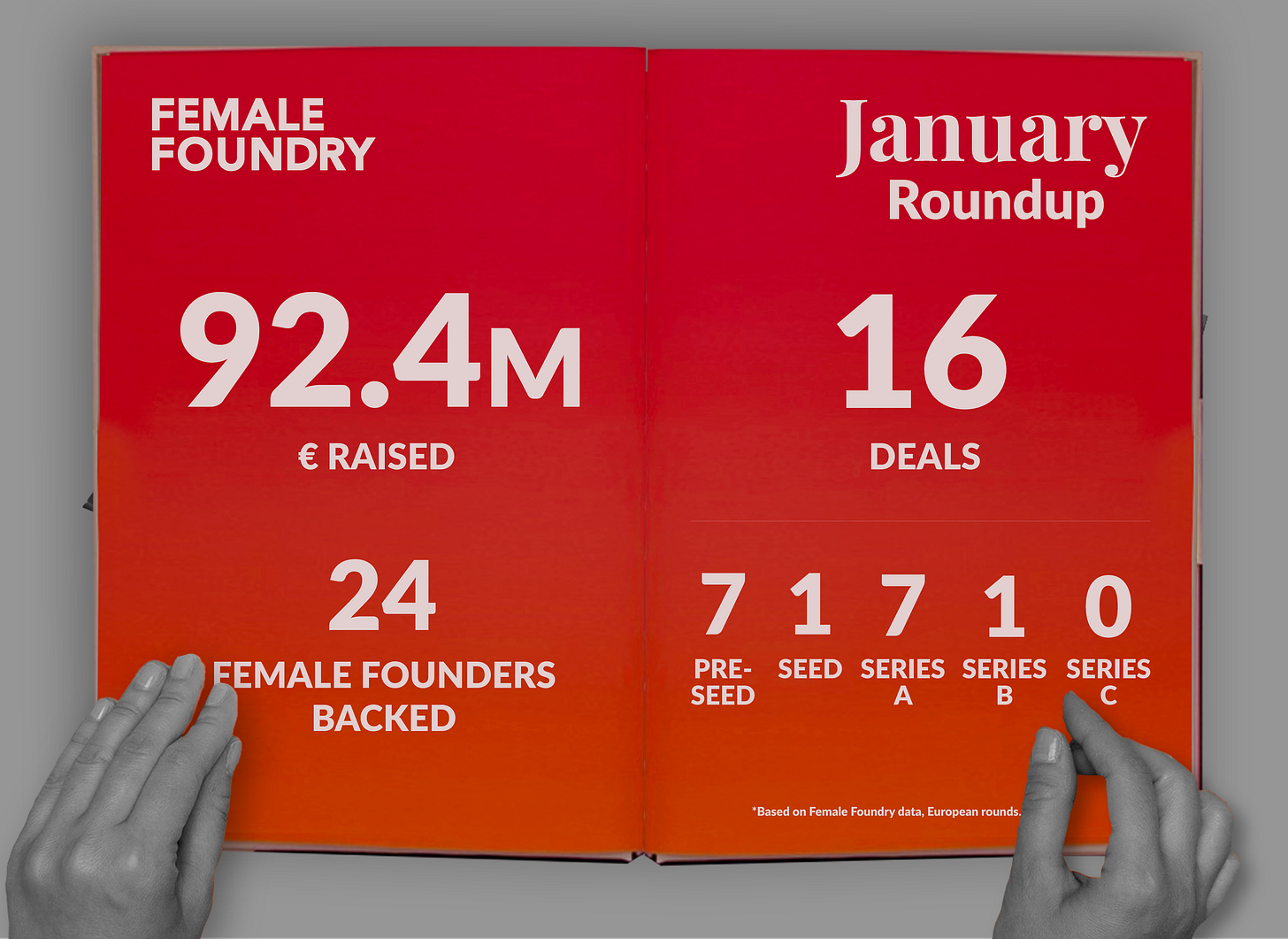

Community fundraising roundup : January.

Despite the slow investment conditions, female founders from the Female Foundry community in Europe raised €92.4m in January - it’s fantastic start of the year!

Investor checklist.

Remember, ultimately, fundraising is not about you, and it is not about investors. It is about the match. So the more you know about potential investors, the higher the odds of your fundraising success! Let’s start with basics - Dealroom, Crunchbase will be helpful here - Do they invest at your stage? In your geography? What sectors? Have they invested in similar businesses? Any potential conflicts of interest? How many investments did they make last year? When did they make their last investment? (Ever heard of zombie funds?) Where in the deployment cycle are they? - I would assume that any 3+ years old fund is at the end of its deployment cycle - and is hard to raise from. Do they lead? Follow up? Harder questions: How do they make investment decisions? Do they have equity ownership targets? (Try speaking with their portfolio founders on that). Where can they bring value? Are they ex-founders? Finally, today there is so much content on social media to help with the last question: do you like them?

Analysis

Secondaries are flooding the market.

Private-debt secondaries are on the rise as market remains undercapitalised, following big-ticket LP portfolio sales driven by falling stock prices and overexposure to private debt. The trade in secondhand stakes hit $17bn in 2022— that is over 30 times the total volume in 2012. At the current rate, the value of secondary deals is expected to reach $50bn by 2026. The average deal sizes have been on the rise too - it is no longer uncommon to see portfolio sales of $1bn in value. Analysts predict, that ongoing economic uncertainty will continue to drive the need for liquidity, and therefore the trend is likely to continue until the end of 2023, impacting the appetite for early stage private equity investments. Read full story ➯

From the Community

Three Point Zero Podcast

Building deep-tech products for maximising value from data with Zuzanna Stamirowska and Claire Nouet, the Founders of Pathway.

This week, I spoke with Zuzanna Stamirowska and Claire Nouet from Pathway who recently raised a €4.5m Pre-Seed round from Inovo and Market One to help companies better handle streaming data (see: Week 49).

In the episode, we talk about building products for maximising value from data, current challenges for AI adoption, how to build technical teams with commercial mindset, what's exciting in the data science development beyond ChatGPT, and why ability to forget can prove crucial for decision making.

Hiring

This week hiring: Luna ➯ Founders Associate | Skipperi ➯ Customer Service Specialist | Cylib ➯ Implementation Partner Manager.

For more listings, check Female Foundry Job Board.

Founder & Investor Meetups

Tuesday, February 14, Berlin ➯ Your key to Startup Success Meetup Wednesday, February 15, London ➯ Networking & Pitching evening Thursday, February 16, Amsterdam ➯ Entrepreneur Mixer, Friday, February 17, Amsterdam ➯ Roundtable Event Investors & Startups.

That’s all for this week! See you next Saturday!

Agata

Written by Agata Leliwa Nowicka, an investor, a two-time entrepreneur, and a founder of Female Foundry based in London.

Suggestions? Drop me an email.

Check femalefoundry.co for more fundraising tools and investor content. View other Female Foundry articles.

♡

Thank you, Mariangela Cordella from Nauta Capital for sourcing our weekly meetups.