Female Foundry Week 105: Great expectations. On market appeal. On profitability. Big techs are scooping top AI talent. Community Fundraising Roundup: March.

Welcome to The Week 105, 2024 Edition of the Female Foundry newsletter!

Female Foundry - where investors and female founders meet.

In the news

Big week for the female-founded London-based startups. London-based fintech startup Levenue, co-founded by Zahra Alubudi, picks up a €1.5m Seed round led by Verb Venture; Also London-based Anima, co-founded by Rachel Mumford, snaps a €11m Series A round led by Molten Ventures to accelerate deployment for its care enablement platform; Another London-based female-founded startup - Stanhope AI, co-founded by Rosalyn Moran, raises a £2.3m Seed round led by UCL Technology Fund for its neuroscience-driven AI platform. And you guessed it - London based - Sapi, co-founded by Mai Le, raises a £7.5m Series A round led by Passion Capital for its for small business lending solution.

On the investment side, Berlin-based World Fund, co-founded by Daria Saharova, closes a milestone €300m fund to institutionalise climate capital in Europe.

Gülsah Wilke, the co-founder of 2hearts collective, joins DN Capital as a Partner - congrats Gulsah!

Spotlight

Great expectations.

Reddit cashed out in a stellar IPO this week, ending its first day of trading in New York up 48% and valuing the social media platform at more than $9bn in a closely watched opening.

The long-awaited IPO, that had been in the works for more than two years, raised $748m and generated about $1.4bn for its largest shareholder, Advance Publications (the company behind New Yorker, Vogue and Wired) that acquired Reddit for a mere $10m in 2006 - just 18 months after its launch. Interestingly, Sam Altman (yep, him again) owns 8.7% after investing in 2014 and is also a lucky winner. Reddit co-founder and CEO Steve Huffman received a $193m pay package last year but Alexis Ohanian, the other co-founder and long the public face of the company did not even appear in the company’s filings.

But what’s perhaps the most interesting about Reddit’s IPO is that it has yet to turn a profit. Many interpret its solid performance as a rebound of the investor appetite for promising yet loss-making companies and the return of ‘junk stock IPOs’. Airbnb, DoorDash, Palantir, Lemonade and Snowflake all joined the public market in 2020 despite being unprofitable at the time of their IPOs - but the fundraising climate and market expectations have since dramatically changed. And so, while Reddit is a great example of a First Mover Network Orchestrator, there are plenty of sceptics. The real test is going to be after the first earnings call, when its monetisation strategy and roadmap to profitability will be scrutinised.

Fundraising

On market appeal.

It has been a great week. I’m currently evaluating a number of opportunities to bring Female Foundry to yet another level - those who know me, know that I don’t stand still. I also met three exciting founders this week - all serial entrepreneurs. What did they have in common? They all built high-growth businesses in uncrowded markets and became experts in making the most of early opportunities to dominate them.

While some were more successful than others, one thing was clear: the originality of their value proposition paired with their growth-hacking mindset helped them to attract customers early on, based on the sheer novelty of their products in their prospective markets. If it all sounds a bit abstract: the vast majority of founders today strive to add incremental value in busy markets.

Employee benefit add-ons, chatbots, sales process optimisation tools, well-being apps, C2C circular-economy marketplaces, digital wallets… the list is long. If you operate in any of those spaces (and other crowded markets - to understand market segmentation read this), you must have a strong USP based on a superb team with deep, unfair market knowledge AND be able to prove it with solid unit economics and traction in order to get anywhere. And so, if you are still early, look beyond market size and its growth, identifying niches that no-one seems to be serving. Is the problem you are trying to solve in those niches significant and growing? How will technology shape them? Who else serves them? Who are their customers? What’s their willingness to pay? Look where no-one is looking, look deeper and reassess.

On profitability.

A few founders asked me recently about current investor expectations when it comes to startups achieving profitability. It’s the wrong way to look at it. What will it take you to achieve sustainable growth? Seed-stage startups now go for 20-24 months on average before reaching Series A - and that does not mean that when they get there the journey becomes any easier. And so, in the current climate, a clear path to profitability is not what ‘investors are looking for’ - it is what companies that are not growing at lightening speed need to master in order to survive.

Analysis

Big techs are scooping top AI talent.

The race to secure top AI talent is underway, with the top tech companies, Amazon, Apple, Google, Meta and Microsoft, increasingly using bold tactics to attract the best AI researchers and tech execs. OpenAI, is increasingly using acquisitions and partnerships (read: Inflection and Mistral) to gain access to top minds in the AI space and bolster its competitive edge (also, making the regulators not very happy). The newly released research states that, apart from generous benefit packages, senior engineers poached by top big tech companies can now earn up to a $10m annual salary.

Community

Community Fundraising Roundup: March

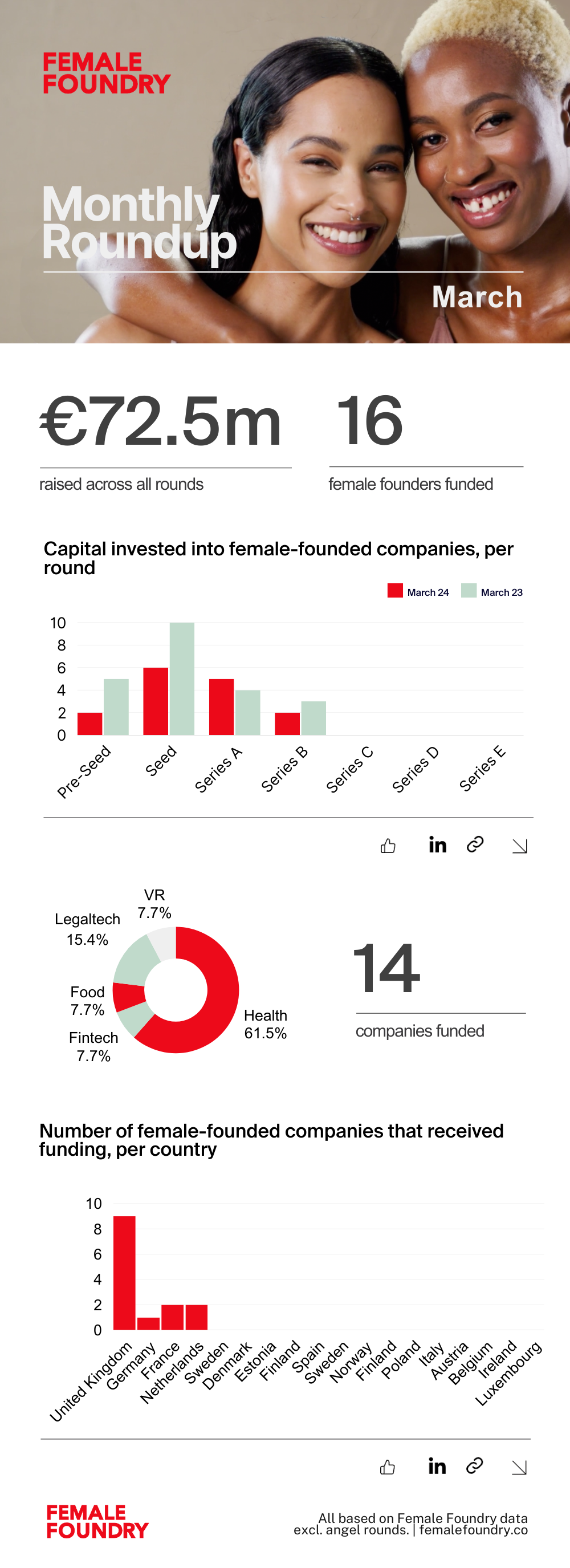

It’s been a steady fundraising month for the female founders from the Female Foundry community in Europe, who raised €72.5m in March.

Let’s meet

On Tuesday, I will be speaking at the SMAU conference in London about ‘Challenges and Opportunities in the European Tech Ecosystem’ ➯ Register here.

Hiring

This week hiring:

Quazy Foods ➯ Head of Product R&D | Haut AI ➯ B2B Marketing Specialist | Planet A Foods ➯ Founders Associate.

See more jobs on the Female Foundry Job Board.

That’s all for now. Enjoy your Sunday and see you next week.

Agata

Written by Agata Leliwa Nowicka, an investor, a startup adviser, a two-time entrepreneur, and a founder of Female Foundry based in London.

Suggestions? Drop me an email.

Check femalefoundry.co for more fundraising tools and investor content. View other Female Foundry articles.